“For unto every one that hath shall be given, and he shall have abundance: but from him that hath not shall be taken away even that which he hath.” — Gospel according to St. Matthew

The effect where there is an accumulated advantage to those who have compared to those who do not have has been identified as the Matthew Effect or Matthew principle due to the above quote from the gospel according to St. Matthew.

The effect was originally documented by influential sociologist Robert Merton in the late 1960s in discussing the inequalities of credit given within scientific research and publications. Merton premised that those scientists who had more standing through a larger body of work often got more credit than those with a smaller body of work, identifying an asymmetry between those with more and those with less.

This effect is well known and easy to see in the economics of wealth and is simply known by the adage: “the rich get richer and the poor get poorer.” In a recent publication outlining the Matthew Effect, it was shown that those who have access to the financial system, in this case, access to financial development and technology, can increase their ability to accumulate wealth. However, getting into the data more deeply, the authors found that those in the upper distributions of wealth used this advantage plus their accessibility to fintech to a much greater benefit to accrue higher rates of return and thus more wealth1. This contributes to a fundamental inequality, the Matthew Effect, that has been a function of how systems of kind allocate scarce resources since biblical times.

Clearly, there is an asymmetry between the haves and the have-nots, which can also be seen in sport.

What does the Matthew effect have to do with the highest levels of human performance?

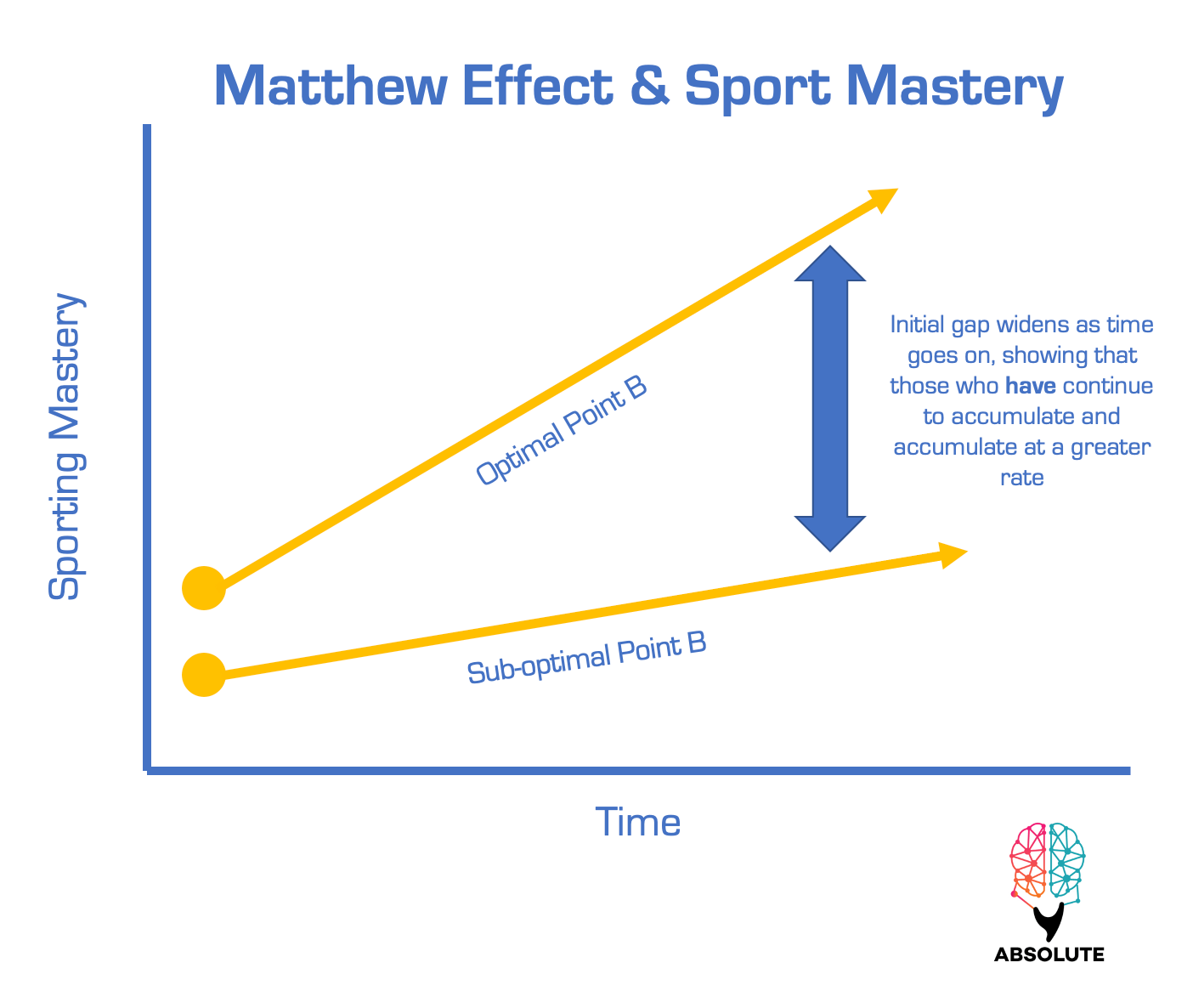

All athletes will benefit from training - investing time in the process of accumulation of physical attributes. We see this regularly. However, there is a definite inequality that exists. Athletes who possess Point B are athletes who have. Athletes who are not in an optimal physical state do not have. This will skew the distribution of continued physical accumulation to those at the higher levels of physical state.

When we synthesize the Matthew effect with Point B, the statement that can be made is that athletes who possess optimal levels of physical capacity — which is the currency required to purchase high sporting mastery, will be able to generate higher rates of return and perform at higher levels of performance repeatedly (i.e., Aaron Judge).

Asymmetries for Athletes Who Have

The term wealth can be applied to many things. Simply by switching from finance to performance, we can link financial capacity to physical capacity. In finance, capacity refers to the amount of liquid capital you may have that allows you to repeatedly make returns on your capital that allows for the accumulation of financial capital as a measure of wealth. Those who possess more liquid capital will have the ability to reap greater rewards. Finance at its core is leveraging capital to create an asymmetry.

Think of the four fundamental physical capacities as a portfolio that is diversified appropriately for the athlete and their demands at the Level of Competition. This portfolio represents a sum total of physical capacity. Physical capacity, then, is an outcome measured by the amount of physical capital that exists within each segment of the portfolio.

Athletes who have, are wealthier and have bigger portfolios. They have greater physical capacities, which will grant them access to more liquid physical capital that allows them to use this to repeatedly re-invest to continually make returns, making them even wealthier in the long run.

Those strength practitioners who understand the Level of Adaptation can now see more clearly how the Matthew effect is in play in the careers of athletes, as this is where access to liquid capital exists. Those athletes who attain high sporting mastery, without a doubt, have an “unfair” asymmetrical advantage of physical capital relative to their competition in their favor as their portfolios are set up in a much different manner.

Much like a financial advisor’s function is to organize and manage financial capital to accumulate even more capital over time, creating wealth, the strength practitioner’s function is to organize and manage training in a manner that accumulates more physical capital over time, creating wealth of a different kind.

Herein lies the asymmetry we as practitioners should be trying to create.

It is the specific and deliberate accumulation of physical capital that allows for an accumulation of physical wealth that breaks the symmetry at the Level of Competition and generates favourable asymmetries for the athletes who have.

To the athletes who possess the most physical capital, the Matthew effect engages for them and the physical currency they possess enables them to consistently generate elite-level performances required to attain high sporting mastery in their chosen sport.

Utilizing Training to Generate The Matthew Effect

It should be the sole objective of the practitioner to utilize training as the mechanism of positive and favourable change to generate the Matthew Effect in the accumulation of specific physical capacities in all the internal ecosystems within the athlete over the career of the athlete.

This hierarchical systematic process of physical capacity accumulation by means of training has been definitively defined in the levels of coaching essay, but is worth restating here:

Recognize there exists an internal and external environment

Establish Point A

Establish Point B

Create the road map from Point A to Point B

Execute + manage the road map over time

Optimally executing and managing the training map over the entire course of the athlete’s career is what leads to the accumulation of physical currency via the nonlinearities of compounding as occurs in the market over time.

It is important to understand that training work is what breaks the symmetry at the Level of Competition, and objectively separates those that have and those that have not.

I know it all depends…but wondering how much influence genetics and/or lack of early specialization (multi sport practice during childhood) of an athlete’s longevity in using and multiplying that physical patrimony/ currency?