The Psychology of Training: Understanding Training Risk: Part 2

Creating a Safe Haven at the Level of Adaptation

In Part 1 of this article, we wrote about the similarities between Modern Portfolio Theory and modern strength training. In doing so, it became evident that in the way that current portfolios are structured and strength training is programmed that there is a deficit in our understanding of risk and how it can be mitigated by acknowledging it as well as accounting for it.

In finance and training in its current structure, the risk and reward are played against each other in an inverse relationship. However, high rewards cannot be attained without undertaking a higher value of risk. The difficulty with this endeavour is the higher potential for loss if the objective amount of risk is not accounted for. This mindset concerning risk must shift, and instead of making the trade-off between risk and return, the question becomes, is there a way to make them directly correlate while at the same time protecting against losses?

In the financial world, those who continue to dive deeper into the understanding of the market using a complex systems approach have begun to provide us with the necessary answers (see: Taleb, Spitznagel amongst other prominent Hedge Fund managers). Understanding the non-linearities of the market helps us to understand that there must be a way that portfolios and the individual can mitigate risk in a volatile environment but ultimately produce very high returns in doing so.

The Concept of a Hedge

In investment speak the ability to match risk to reward comes with understanding the concept of hedging. As a general strategy, hedging has a major advantage in that it can protect your capital from being exposed to higher amounts of risk that may wipe it out. In slightly more practical terms, think of hedging as adding a form of insurance within your asset classes protecting against potentially unexpected losses. However, hedging strategies are not as simple as just “buying” insurance, as there is no true insurance available within the market. As such, hedging becomes a strategy whereby the owner/manager of the portfolio must use particular financial vehicles to logically accrue capital (or at least not lose any!) while shielding that capital from the unexpected ebbs and flows of the market that may influence it negatively.

Tail events are those that occur with a very small probability. As alluded to previously in Part 1, the major misconception concerning modern investing is that the returns from the market follow a normal distribution - which couldn’t be further from the reality. Again, if this were the case, it would be very easy for an investor to mitigate risk and maximize rewards because it would all be equal - but it’s not! Risk is skewed towards the ends of a normal distribution, otherwise known as the tails and aptly termed “tail-risk.” These are regions within the normal distribution whereby the chance of an event occurring is very small; however, if it does, it can lead to exponential losses. These tails are what Taleb1 refers to as “fat-tails” and can be taken advantage of if there is a risk-mitigating strategy in place that protects against downside losses.

At Absolute, we have referenced injuries to be Black Swans, those things that occur outside the normal distribution. Therefore, injuries aren’t normal and should not be a normal occurrence and can be more appropriately mitigated when understanding the risks at the Level of Competition (the market). When looking at injuries in this way, it allows for a more complete strategy to manage the athlete for the volatility involved in the sporting environment.

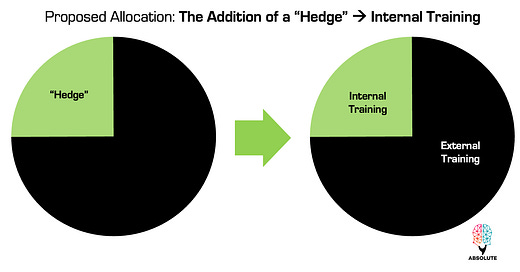

This is where hedging comes in. Tail hedging has been shown to be a very systematic way to balance risk in the market by building capacity within the portfolio (internal capacities), which then allows for the undertaking of higher risk activity to produce maximal returns. This is done by changing the allocated percentages of stocks (making them higher) and bonds and allocating to include a form of “insurance” within the portfolio (the hedge, which are often options/put strategies). This allows the portfolio to ride the waves of volatility of the external market, which cannot be adequately controlled by building small incremental amounts of capital from the inside. This grows and grows, and as it does it builds wealth within the portfolio. It makes the portfolio more resilient when market shock occurs, but even more, it allows the owner of the portfolio to make exponential gains and take advantage of these tail events.

Using modern strength building theory can we be confident in our understanding of what the trainee (the system) needs to manage itself in a volatile environment? Are we confident that the system (the trainee) won’t be disrupted by small perturbations that occur repeatedly over time? How do we know?

These are tough questions that are unanswerable for many. They become easier to answer if we simply understand that for the athlete (the portfolio), there are two environments that training can occur in, one is far more controllable than the other and allows for protection, and the other is far more volatile but allows for the greatest potential. We must attempt to bridge this chasm. This is the important and necessary role of internal training.

In this way, internal training, focussing on the biological structures and the emergent behaviours of them, acts like a hedge for the athlete to allow them to undertake other training means that have higher amounts of risk but generate large returns. This form of internal hedging in a physical capacity sense acts in the same way in that it can create resilience for the athlete.

Hopefully, the analogy I’m making is becoming clearer as what we refer to as internal training for the development of internal capacities is, in essence, a training hedge that buffers the trainee throughout the training process. Much like the market, the external environment is fraught with volatility that must be accounted for; that can only come with the understanding that modern strength building theory has to change to include training that allows for strength to be built from the inside and, thus, allows the trainee to better be able to manage external volatility and risk.

The Barbell Strategy

This brings us to the barbell strategy conceptualized by Nassim Taleb2.

Keeping in mind Taleb conceptualized the strategy within the financial markets, he describes the barbell strategy’s underlying principle this way:

"If you know that you are vulnerable to prediction errors, and accept that most risk measures are flawed, then your strategy is to be as hyper-conservative and hyper-aggressive as you can be, instead of being mildly aggressive or conservative."

Therefore, the middle does not exist. No system can succeed with maximal returns from being at the top of a bell-shaped curve - this simply means you are repeatedly generating average returns. There is a reason all great investors avoid this. There is a reason that many great sport coaches simply cut out the medium-effort training with no intent. In the end, it serves as simply a pull of resources from the athlete with little possibility of a return.

This strategy is a very easy way to understand risk and benefit. This is important in the application of inputs in both treatment and training. As we have discussed, we need to provide so-called riskier inputs or interventions as they provide for the biggest payoff at any point in time; however, this must be understood, accounted for, and provided for on the other side so that the chance of adverse behavior (injury or some other negative consequence) is small.

As you can see, the barbell is asymmetric. All complex systems benefit from asymmetries. Taking it a step further, there is an important distinction of asymmetry that best maximizes the benefit. Shielding us from loss aversion is entrenched in the barbell strategy. Here is why.

Over time (the time frame must be determined), if there is more to lose than to gain, then there exists an unfavourable asymmetry. (If the downside is larger than the upside).

Over the same time frame, if there is more to gain than to lose then there exists a favourable asymmetry. (If the upside is larger than the downside).

As a priority, the barbell strategy insists that we must minimize downside risk before trying to increase the upside. This is key as often training is about just pushing the upside over time, yet this is skewed on the downside asymmetry as there exists a much larger probability to undertake a loss when training in this fashion.

This is the purpose of the FRS Strength Model. It is designed upon this strategy to maximize strength without being harmed in the process of acquiring it.

Great article ✊🏻

Great writing.

Holy Grail. “...strategy to maximize strength without being harmed in the process of acquiring it.”